Online Investment Calculator

Investing in a systematic manner with debt mutual (better than FD) is a good way of generating tax adjusted wealth.

What is FD?

Fixed deposit or FD is a saving instrument which bears a fixed rate of interest payable on maturity along with the principal amount. These are suitable for those conservative investors who do not want take any kind of risk and want to grow their wealth slowly and steadily.

Important Things Which One Should Know Before Opening FD

Form 15G/15H

In order to prevent TDS deduction from your interest income, one can submit forms 15G or 15H.

Form 15G - For individuals who are below 60 years

Form 15H - For senior citizens.

These forms are basically self-declaration forms which states that the total income of the FD holder is below the basic exemption limit of that assessment year and hence no TDS is to be deducted.

Important point:- In case an individual forgets to submit these forms while opening FD, he can claim tax refund while filing returns.

TDS

Interest income earned from FD's is fully taxable in the hands of the investor. Hence, the banks are required to deduct TDS@10% if the interest earned on fixed deposit exceeds Rs 10,000. While if the investor failed to provide his PAN number then the TDS will be deducted at the rate of 20%.

Loan facility

Overdraft facility is available to all FD investors. Bank provides loan facility up to a maximum limit of 90% of the FD amount and charges 1% higher over and above the FD interest rate.

All the deposits are insured by DICGC (Deposit Insurance and Credit Insurance Corporation) up to a limit of Rs 5 lacs for the interest as well as the principal amount per bank. Ex - If you have an FD of Rs. 200,000 each in 5 branches of the same bank, then the total amount of FD would be 10 lacs but DICGC covers only 5 lacs in case of default by the bank.

Renewal facility

One can give instructions of auto-renewal to the bank. So on maturity, it will be renewed automatically with the same principal amount or as directed by the investor.

What is the maturity amount in FD?

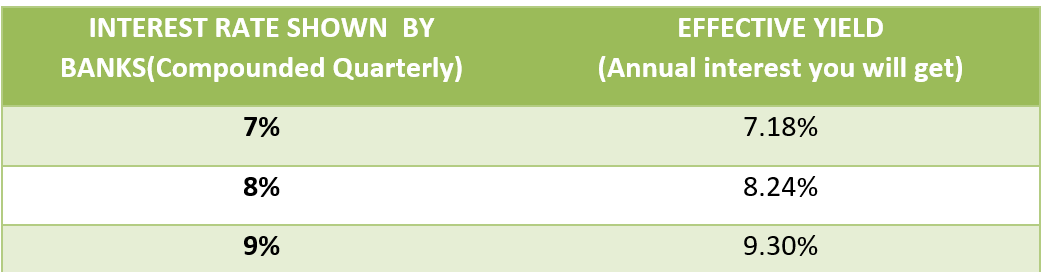

The maturity amount in FD is the sum total of principal plus the interest earned during the tenure. The interest is generally compounded on a quarterly basis which is why the interest you earn is slightly more than the interest you see.

Maturity Amount = Principal Deposited + Interest Earned

What are the interest rates offered by banks on FD?

The interest rates being offered by SBI on 1 year FD is 5.70% (w.e.f 28/03/2020) with the provision of providing an extra 0.25% - 0.50% to senior citizens. However, there are some private banks or cooperative banks which may offer a higher rate of interest.

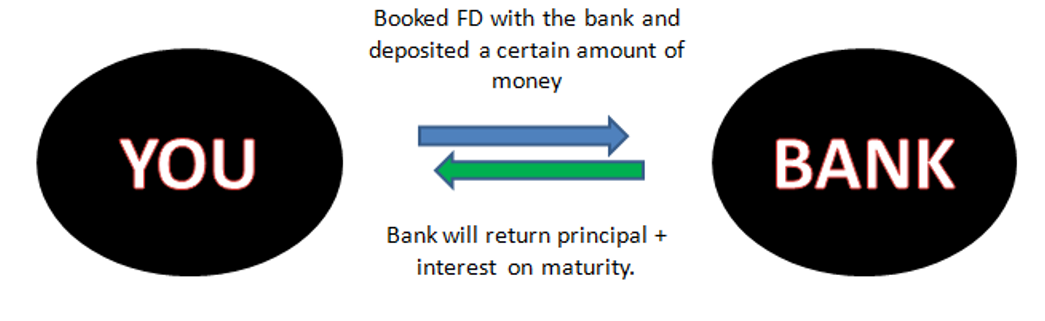

How does a fixed deposit work?

When you open a fixed deposit account with a bank, the bank promises to pay a fixed rate of return which is decided at the time of opening FD and you on the other hand promise that you will not withdraw your investment before. However one can withdraw his investments before maturity by paying some penalty.

What is the minimum period for a fixed deposit?

The best part about FD is that they are very flexible in nature. One can invest for as low as 7 days up to a maximum period of 10 years. Also, one can choose the auto-renewal facility provided by the banks.

How to open a fixed deposit account?

In order to open a fixed deposit account, one can visit the nearby bank branch or can even open it through online net banking. In case the investor does not hold a savings account with the bank in which they want to open FD then they are required to submit other documents as well.

What are the documents required for a fixed deposit?

One has to submit documents for identity proof and address proof along with the request form for the opening a fixed deposit account. Also, one must not forget to submit his PAN card with the banks because in case of its absence the bank will deduct TDS@20% on the interest income.

Can we open a fixed deposit without a bank account?

Yes, most of the private banks and cooperative banks allow an investor to open a fixed deposit without having a saving bank account with the same bank. However, some of the PSU banks require the prior opening of the bank account.

Is the interest income from FD taxable? Also is there any way of getting tax deduction in case of FD's?

Yes, the whole of the interest income is taxable in the hands of the investor as per one's tax slab. Also, contribution in 5 years FD's is eligible for tax deduction under section 80C up to a limit of Rs 1.5lacs.Further Reading: